Assess also compare to Get into Medicare Advantage Plans: Cut Hundreds with Insurance so you can Start Here

Exploring Medicare Advantage Plans

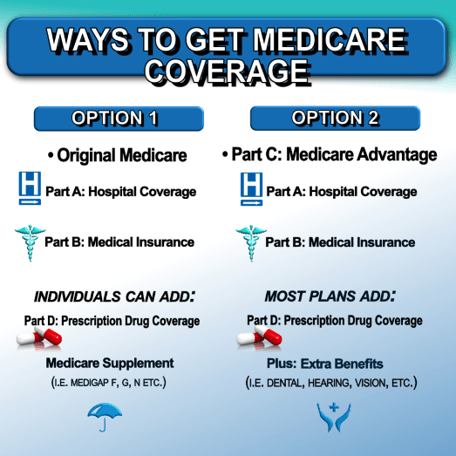

Medicare Advantage Plans exist as provided by private Insurance providers that work alongside Medicare to provide Part A also Part B benefits in one unified combined structure. Unlike traditional Medicare, Medicare Advantage Plans commonly feature extra coverage such as prescription coverage, oral health care, vision services, in addition to health support programs. Such Medicare Advantage Plans run within established service areas, making residency a key factor during comparison.

How Medicare Advantage Plans Vary From Original Medicare

Original Medicare allows wide provider access, while Medicare Advantage Plans generally use structured networks like HMOs and/or PPOs. Medicare Advantage Plans may require provider referrals and/or network-based providers, but they commonly offset those constraints with structured expenses. For numerous beneficiaries, Medicare Advantage Plans offer a balance between cost control and also added services that Original Medicare independently does not typically provide.

Which individuals May want to Consider Medicare Advantage Plans

Medicare Advantage Plans appeal to beneficiaries interested in managed healthcare delivery as well as potential cost savings under one unified policy. Seniors handling chronic health conditions often select Medicare Advantage Plans because connected care approaches reduce complexity in treatment. Medicare Advantage Plans can also interest people who prefer bundled services without handling separate secondary policies.

Eligibility Criteria for Medicare Advantage Plans

To be eligible for Medicare Advantage Plans, enrollment in Medicare Part A and also Part B is required. Medicare Advantage Plans are available to most individuals aged 65 along with older, as well as under-sixty-five individuals with qualifying medical conditions. Participation in Medicare Advantage Plans depends on residence within a plan’s coverage region and also timing aligned with approved enrollment periods.

Best times to Choose Medicare Advantage Plans

Proper timing holds a key part when enrolling in Medicare Advantage Plans. The Initial Enrollment Period centers around your Medicare eligibility milestone also allows first-time choice of Medicare Advantage Plans. Overlooking this period does not necessarily eliminate access, but it often limit available options for Medicare Advantage Plans later in the year.

Annual not to mention Special Enrollment Periods

Every autumn, the Yearly enrollment window permits enrollees to change, remove, or enroll in Medicare Advantage Plans. Special Enrollment Periods become available when life events take place, such as relocation and coverage termination, allowing changes to Medicare Advantage Plans outside the standard schedule. Knowing these timeframes ensures Medicare Advantage Plans remain accessible when circumstances change.

Ways to Review Medicare Advantage Plans Effectively

Evaluating Medicare Advantage Plans requires care to more than recurring premiums alone. Medicare Advantage Plans vary by network structures, annual spending limits, prescription lists, not to mention benefit rules. A thorough review of Medicare Advantage Plans assists aligning medical priorities with plan designs.

Expenses, Coverage, & Network Networks

Monthly costs, copays, & yearly caps all define the value of Medicare Advantage Plans. Certain Medicare Advantage Plans offer minimal monthly costs but increased cost-sharing, while alternative options focus on predictable expenses. Provider access also varies, making it important to check that chosen doctors participate in the Medicare Advantage Plans under review.

Prescription Benefits and also Extra Benefits

A large number of Medicare Advantage Plans provide Part D drug benefits, easing prescription management. Beyond prescriptions, Medicare Advantage Plans may offer fitness programs, ride services, and/or OTC allowances. Reviewing these extras supports Medicare Advantage Plans match with daily healthcare requirements.

Joining Medicare Advantage Plans

Sign-up in Medicare Advantage Plans can take place digitally, by telephone, along with through authorized Insurance Agents. Medicare Advantage Plans require correct personal details with confirmation of eligibility before activation. Submitting registration carefully prevents processing delays plus unexpected coverage gaps within Medicare Advantage Plans.

Understanding the Value of Authorized Insurance Agents

Licensed Insurance professionals assist interpret coverage details & describe differences among Medicare Advantage Plans. Speaking with an expert can clarify provider network rules, coverage boundaries, in addition to expenses tied to Medicare Advantage Plans. Expert assistance frequently accelerates the selection process during sign-up.

Typical Mistakes to Watch for With Medicare Advantage Plans

Ignoring doctor networks stands among the frequent mistakes when evaluating Medicare Advantage Plans. Another problem centers on concentrating only on premiums without considering overall expenses across Medicare Advantage Plans. Reviewing plan materials carefully helps prevent misunderstandings after sign-up.

Reviewing Medicare Advantage Plans Each Coverage Year

Healthcare priorities change, & Medicare Advantage Plans change annually as part of that process. Reassessing Medicare Advantage Plans during open enrollment periods enables changes when benefits, costs, with doctor access change. Ongoing review helps keep Medicare Advantage Plans aligned with present medical needs.

Why Medicare Advantage Plans Continue to Grow

Participation trends indicate growing demand in Medicare Advantage Plans nationwide. Expanded coverage options, defined out-of-pocket caps, with integrated healthcare delivery help explain the growth of Medicare Advantage Plans. As offerings multiply, informed comparison becomes increasingly valuable.

Ongoing Value of Medicare Advantage Plans

For a large number of individuals, Medicare Advantage Plans deliver stability through integrated coverage along with organized care. Medicare Advantage Plans can reduce management burden while supporting PolicyNational preventative care. Selecting appropriate Medicare Advantage Plans establishes assurance throughout later life years.

Compare & Choose Medicare Advantage Plans Today

Making the right step with Medicare Advantage Plans begins by reviewing available options along with confirming qualification. If you are currently entering Medicare even revisiting current benefits, Medicare Advantage Plans provide adaptable coverage options built for varied healthcare priorities. Review Medicare Advantage Plans now to secure coverage that fits both your medical needs plus your budget.